Back

Back

On August 30 2021, KWG Group held the 2021 Interim Results Conference. Group Chairman and Executive Director Kong Jianmin, CEO and Executive Director of real estate business Cai Fengjia, Senior Consultant Xu Jintian, Vice President of Finance and Capital Huang Yanping, Vice President of Operations Xu Kangliang, and Vice President of Overseas Financing of Investor Relations and Capital Markets Huang Yishan attended the meeting.

KWG Group 2021 interim results conference site

In the complex and changeable market environment in the first half of the year, the Group has always adhered to the strategic direction of steady operation and coordinated development. Based on the present and taking a long-term view, the company has deepened diversified layout, persisted in innovation-driven, promoted digital transformation, continuously improved organizational capacity and operation and management level, and a number of business indicators have grown steadily.

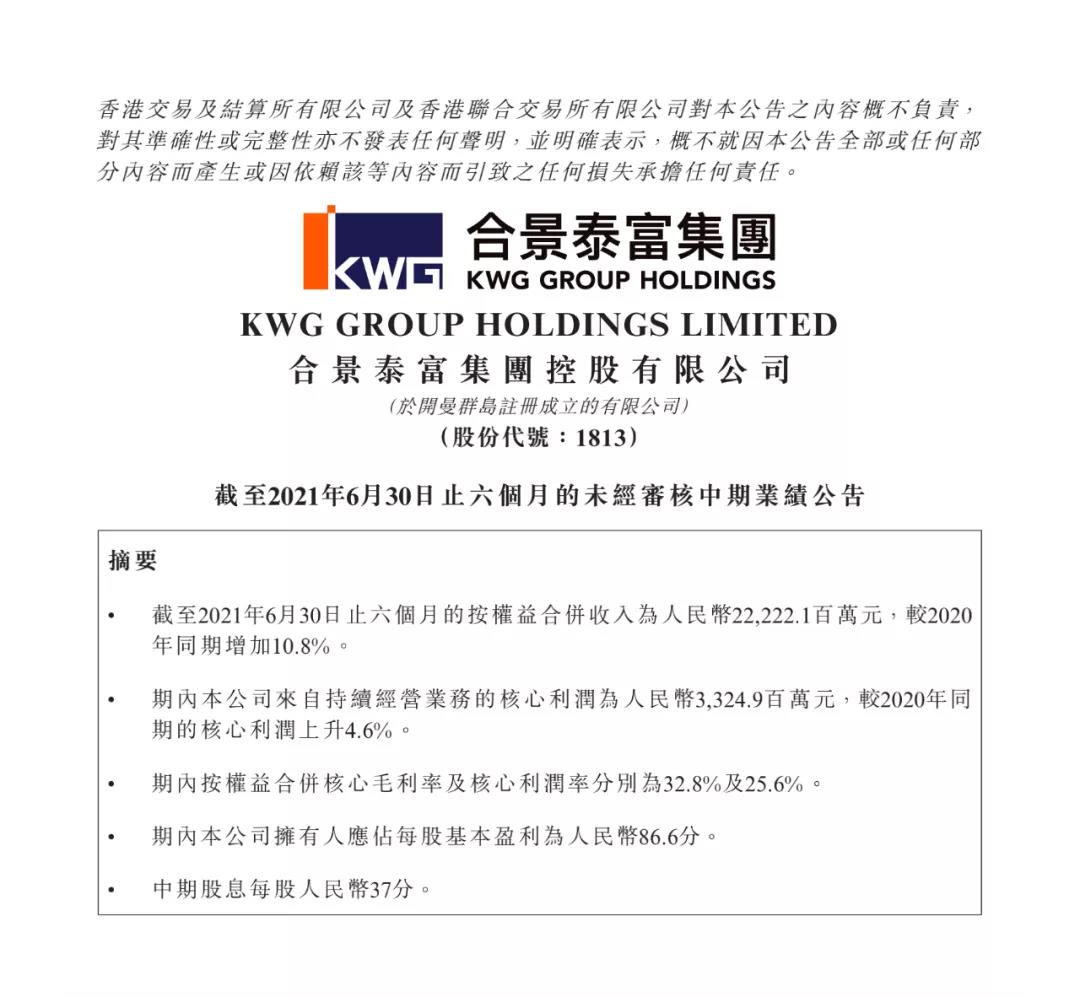

According to the group’s semi-annual report, as of June 30, 2021, KWG Group’s multi-directional indicators are stable and positive:

The consolidated revenue by equity reached 22.222 billion yuan, an increase of 10.8% over the same period in 2020.

Consolidated core gross profit based on equity was about 7.283 billion yuan, an increase of 12.3% compared with the same period in 2020.

Core profit from continuing operations was 3.325 billion yuan, up 4.6% from the same period in 2020.

Consolidated core gross margin and core margin by equity were 32.8% and 25.6%, respectively.

The basic earnings attributable to the owners of the company is RMB 86.6 cents per share. The company's board of directors recommended an interim dividend of RMB37 per share, representing 35.4% of core profit.

“Build ecology, create the future by digital” the 2021 interim results of KWG

Mr. Kong Jianmin, chairman and executive Director of the group, said that the most important thing for enterprises is to be good at themselves and improve speed, reduce cost and increase efficiency through digital transformation. In the future, the group will continue to focus on the real estate, shopping malls, office buildings, hotels and other diversified business forms, under the digital addition, to form a cooperative and organic integration of the landscape ecosystem.

KWG Group has been pursuing “quality growth” to achieve steady growth in scale and operating performance under the premise of operating and financial security. In the first half of 2021, in a complex and volatile market environment, the company’s core business indicators are still commendable and outstanding.

With excellent product building and operation management, the group has maintained a competitive position in the industry in terms of revenue and profit.

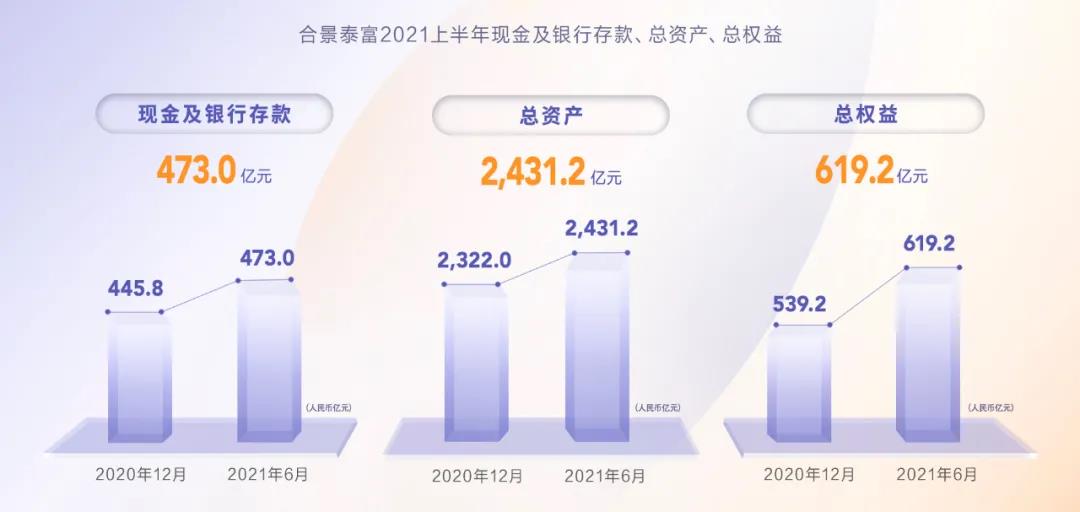

In the first half of this year, the Group accelerated sales collection, continued to optimize the capital structure, to create a more robust and safe financial situation. By the end of the report, the group's total assets are 243.12 billion yuan, total equity 61.92 billion yuan, cash and bank deposits 47.3 billion yuan. Debt structure is more optimized, the comprehensive financing cost is 6.1% which is 0.1 percentage point lower than last year and at a reasonable level in the industry.

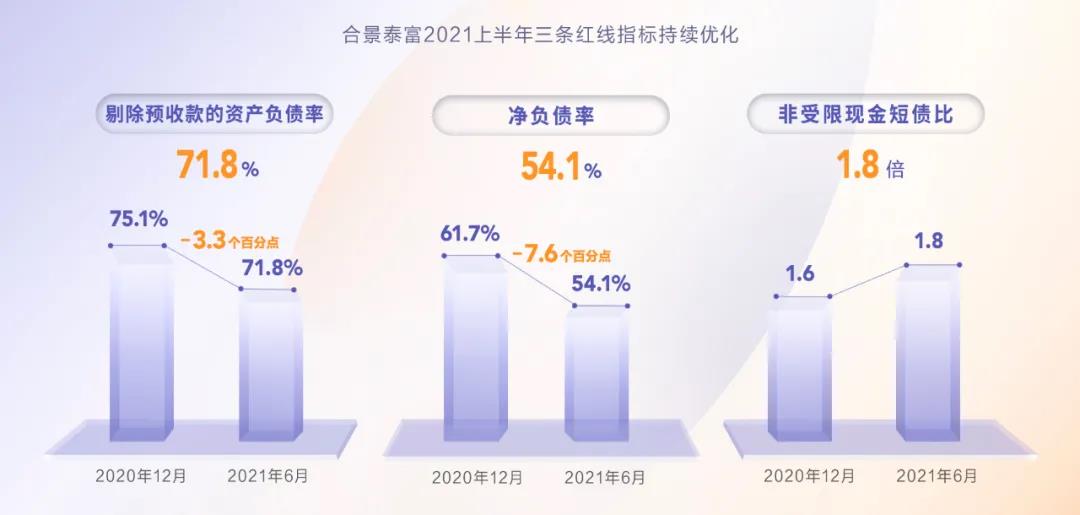

In the first half of this year, the company complied with the national macro policies and continued to optimize the three red line indicators. Among them, the asset-liability ratio excluding prepaid accounts was 71.8%, down 3.3 percentage points from the end of 2020. The ratio of unrestricted cash to short debt was 1.8 times, further increasing from 1.6 times at the end of 2020. The net debt ratio was 54.1%, down 7.6 percentage points from the end of 2020, a low position in the industry.

Since 2021, under the principle of “houses are for living in and not for speculative investment” , local governments have further implemented the policy of “stabilizing land prices, housing prices and expectations”. The national market began to develop in a more stable and healthy direction. Facing the new market demand and policy environment, the real estate industry will face new challenges, which put forward higher requirements for enterprise management level. As a stable business style, KWG in the face of market fluctuations, maintain strategic focus, performance to maintain beautiful growth.

By the end of June, the group achieved a total of 56.2 billion yuan in pre-sales in the first half of the year, up 53% year on year, fulfilling the annual plan as planned.

In terms of land reserve, the Group insists on regional deep cultivation and quality growth, actively layout the Greater Bay Area, Yangtze River Delta, Bohai Rim and central and western in China, and has more than 200 projects in 41 cities across the country. According to the city level, 95% are from the first and second tier cities, which are the areas with great potential for future domestic industrial development and population growth, largely ensuring the robustness of the group's future operation under the changing market environment. In the future, the group will continue to deepen the diversification strategy of land acquisition channels and continue to focus on deep cultivation in key areas.

In the first half of 2021, the group launched a total of THE BERYL, THE RIVIERA, THE JADEITE, HAYA city and other new projects. Among them, there are many high-end projects. The new projects win with superior location, high-quality products and design, and get widespread attention from the market.

Xu Kangliang, vice president of operations of the company, said that the company believes that through continuous product innovation and continuous upgrading of residential and commercial products, it can achieve better market and customer satisfaction in the future, and achieve better profit performance. We always pursue perfect product design.

In addition, the group will actively promote the expansion and implementation of urban renewal projects. In the first half of 2021, the Group accurately grasped the pulse of The Times, deeply engaged in the urban renewal of the Greater Bay Area, and made new breakthroughs in the layout of the urban core area. By the end of the report period, the Group has successfully won the cooperative subject qualification of three old village reconstruction projects, which are Jishan village Tianhe district Guangzhou, Shuangsha village Huangpu district Guangzhou and Shixia village Zengcheng district Guangzhou. As the group continues to advance the pace of urban renewal, it will continue to provide high-quality land reserve for the group through duplicate effect in the future.

As a compound real estate enterprise, KWG began to lay out its commercial territory from 2008. After more than ten years of precipitation, the commercial territory has been booming, layout in the Guangdong-Hong Kong-Macao Greater Bay Area, Yangtze River Delta, Bohai Rim, Chengdu, Chongqing, Nanning and other core areas of the first and second tier cities and new economics zones.At present, the group has opened a total of 41 investment projects, including 10 shopping malls, 9 office buildings, 22 hotels. In the future, 25 new shopping malls and 11 new office buildings will be opened one after another. Self-owned brand hotels will develop towards large-scale development through the combination of heavy and light assets. Investment properties will continue to provide stable cash inflow and profit support for the Group, and the group’s real estate business will drive through the economic cycle.

At present, the group has opened 10 stores in Guangzhou, Beijing, Shanghai, Chengdu, Suzhou and Foshan. With the normalization of epidemic prevention and control, the shopping malls of the Group are empowered digitally through new consumption formats and innovative offline activities to expand the consumption ecosystem. In the first half of 2021, rental income increased by 55.3% to RMB901 million, while the overall occupancy rate of shopping malls operating for more than six months reached 89%, and passenger flow increased by 88% year-on-year. Retail sales are up more than 82% from a year ago.

In terms of hotel operation, the group has opened 22 hotels, including cooperation with international liquor management group and its own brand hotels. Among them, the self-owned brand The Mulian Hotel Group has accumulated successful experience in cooperation with international five-star hotels for 8 years. Under the strategy of combining light and heavy assets, with mature and refined hotel design, development and investment management capabilities, The Mulian Hotel has been distributed in 8 first and second tier cities in China, and has opened 17 hotels in total.

In the next five years, The Mulian Hotel management group is committed to becoming the most competitive owned hotel brand in China. In the future, it will comprehensively apply the asset-heavy and asset-light modes to carry out rapid expansion and scale development to help the second curve growth of the Group.

In order to cope with the development trend of the industry and the constantly upgraded market demand, the digital transformation of the real estate industry has been an inevitable trend.

As early as 2018, the Group has started its digital transformation. In 2021, the group will continue to deepen cooperation with IBM and officially launch the hr DHR digital platform project. From the perspective of scenario thinking and digitalization, we can optimize the business process of organization planning, personnel recruitment, attendance and salary, training performance and talent development. In-depth business coordination and linkage, in-depth empowered human lean management, implement the company’s industry and financial integration strategy. With forward-looking development strategy, comprehensive operation strength of multiple collaboration, excellent product capability strength, continue to drive a jump in brand value, repeatedly recognized by the authority. In 2021, with strong comprehensive strength, the Group won several awards: 2021 TOP 100 Real Estate Enterprise of China, TOP 10 Profitable Real Estate of China, TOP 10 Comprehensive Development Enterprises of China in 2021, TOP 5 Development Speed of China’s Listed real estate companies in 2021, TOP10 comprehensive strength of China’s listed real estate companies in Hong Kong, 2021 APEA Award for Excellence Business Management, 2021 Forbes China best employer, 2021 Forbes China sustainable development employer, etc.

Look forward to the future, with the group’s mature commercial operation system, high-quality operation platform, and experienced team. KWG will continue to enrich the business form, multiple track together. To create a full range of business chain, coupled with the group’s digital transformation. It will provide technical dividends for the company to improve efficiency and create stable income. Throughout the development path, KWG’s future will be more stable, more effective long-term approach.